The tempest of tariffs, trade wars, inflation fears, and recession fears have dizzied investors for the last three months. Where should investors put their money to protect against all this risk?

I’ve outlined a few recession-resilient real estate investments I like, but let’s dig deeper into REITs. Real estate investment trusts offer the easiest way to invest passively in real estate since you can buy shares with your brokerage account. They also come with their share of downsides and risks, which we’ll touch on later.

REITs & Recession Risk

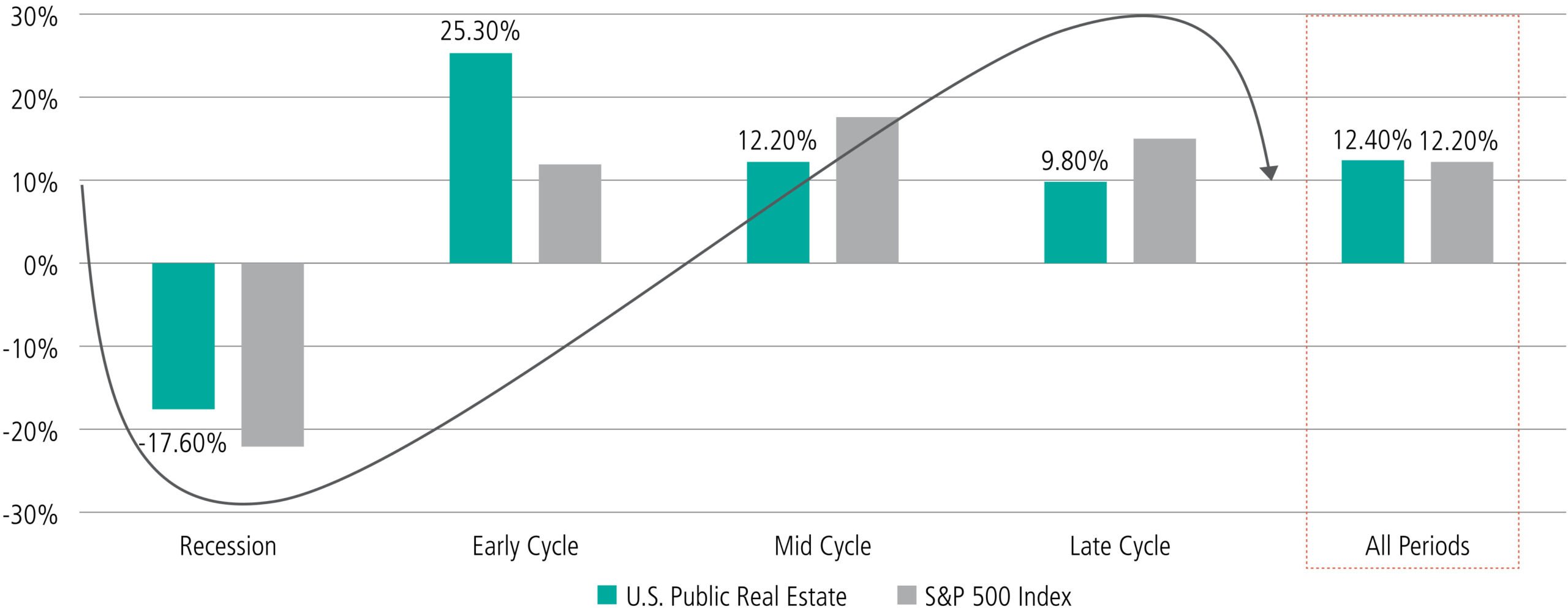

Let’s get this out of the way now: REITs crash before and during recessions. And they crash hard, with an average return of -17.6% during recessions going back to 1991:

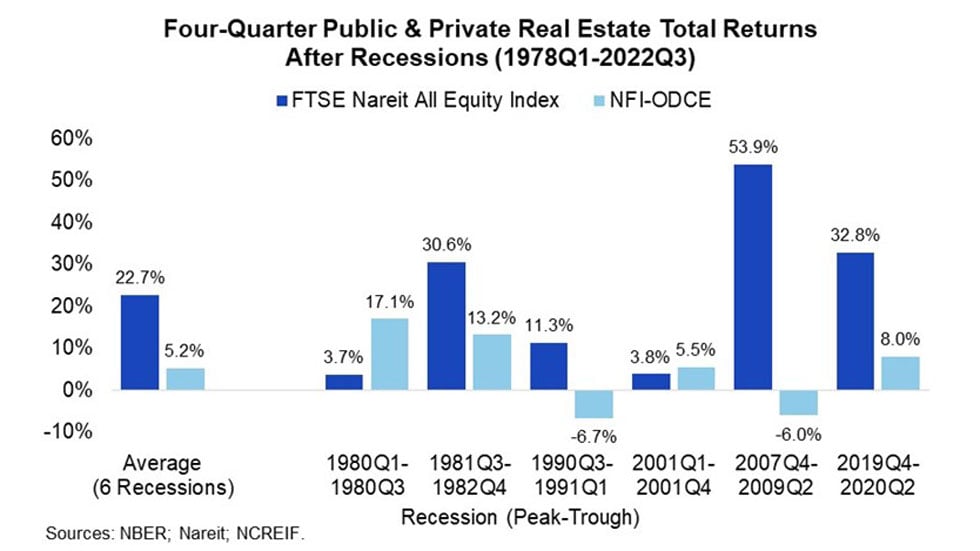

That said, REITs respond to market changes much faster than private property prices because REITs are publicly traded. You can see that play out in the data.

In the average four quarters before recessions, REITs have underperformed privately owned properties:

But in the four quarters after recessions, REITs have beaten privately owned properties:

The data is clear: Once a recession strikes and REIT prices dip, historically, that’s a great time to buy.

Specific REIT Sectors That Shine in Recessions

Some types of REITs do just fine in recessions. Others ride the struggle bus downhill.

Specifically, Wide Moat Research points to REITs specializing in healthcare, data centers, and triple net leases as survivors in recessions. On the other end of the spectrum, the company warns investors that hotels, billboards, and mortgage REITs suffer.

In fact, it cites research that if you remove mortgage REITs from the data, equity REITs actually average an annualized return of 15.9% during recessions. Not too shabby!

How REITs Have Moved Recently

After a flash crash early in the COVID-19 pandemic, REITs skyrocketed until early 2022, when the Federal Reserve started hiking interest rates. That hasn’t gone well for REITs.

The annualized price returns for U.S. REITs have averaged -7.29% over the past three years. Meanwhile, the price return for the S&P 500 has averaged nearly 8%.

And no, the numbers don’t get much better when you include dividends. The net total return for U.S. REITs has averaged -4.69% a year in that period, while the S&P 500 has averaged 9.14%.

More recently, U.S. REITs shot up last year when interest rates started declining. But they’ve crashed back down again over the last two months of tariff turmoil, falling 7.6%.

Volatility

As publicly traded assets, REITs bounce around with almost as much volatility as stocks.

You can measure volatility with beta. The beta of U.S. REITs compared to the S&P 500 is 0.75—in other words, REITs are 25% less volatile than stocks.

Privately owned real estate has a far lower beta. The less liquid an investment is, the lower its volatility tends to be.

Correlation to Stocks

I invest in real estate for many reasons: cash flow, tax advantages, long-term appreciation, and the ability to leverage other people’s money. But just as important to me as all of those is diversification. I invest in real estate as a counterweight to my stock portfolio.

Therein lies one of the biggest problems with REITs: They correlate too closely with the stock market at large and act as just one more sector of it.

Check out the full graphs and data on REITs’ correlation to the stock market here. I generally avoid REITs for this reason.

Other Passive Real Estate Investments I Prefer

Like the idea of a completely hands-off real estate investment, but don’t want REITs’ volatility and correlation to stock markets? Me too.

I get together with a group of other passive investors every month through a co-investing club to vet a new investment. Each person can invest $5,000 or more, and collectively we’ll surpass the $50,000-$100,000 minimum.

Here are a few types of passive investments that we go in on together.

Private partnerships

Often, we’ll partner with an active investor on a deal or series of deals.

For example, last month we partnered with a land-flipping company. They’ll flip as many parcels as they can with our money between now and the end of 2027 and pay us out our profits each time a parcel sells.

We made a similar partnership with a house-flipping company last fall, and with a spec home construction company. I personally love private partnerships.

Private notes

Likewise, we love investing in private notes for steady and predictable income. In our club, we typically go in on secured notes paying 10%-16% interest.

Real estate syndications

Some people find syndications intimidating. Don’t let them scare you. One of the reasons we love investing as a club is that we can all vet these together. It lowers the risk when you have 50 sets of eyeballs, all reviewing a deal and discussing it together on a Zoom call.

The bottom line: You get the cash flow, appreciation, and tax benefits of owning real estate without having to become a landlord.

Buy REITs Right Now?

Now isn’t a bad time to buy REITs, all things considered. But I’d still rather invest privately.

If you insist on timing the market—which I don’t recommend—the best time to buy REITs tends to come in the darkest days of a recession. “Blood in the streets” and all that.

Of course, everyone’s still panicking then, so no one feels like buying. You won’t want to buy, either.

That’s why I practice dollar-cost averaging for real estate investments. I invest $5,000 in a new real estate deal every month, rain or shine, rainbow or recession.

Analyze Deals in Seconds

No more spreadsheets. BiggerDeals shows you nationwide listings with built-in cash flow, cap rate, and return metrics—so you can spot deals that pencil out in seconds.