Private capital markets are no longer a side story in global finance. Despite the sector’s insistence that it brings many benefits to the broader economy, the growing size of private capital markets is raising concerns about the systemic risks that both private equity (PE)[1] and private credit[2] may pose.

With trillions in assets now tied up in private markets, sluggish deal activity[3] and a general sense of market saturation[4] have intensified the uneasiness, concerns that extend beyond policymakers to institutional investors whose portfolios are directly exposed.

Before the global financial crisis (GFC), critics of private equity were mostly confined to trade unions and left-leaning politicians,[5] and PE fund managers could get on regardless.

The anxiety is spreading, however, reaching even pro-market apostles. A recent cover story in The Spectator — the politically conservative magazine owned by hedge fund investor Paul Marshall — examined how private equity funds “ruined Britain” by mishandling many of the businesses under their custody.[6]

Individual Sectors at Risk: When PE Practices Spread

Whilst the debate about a proper definition for systemic risk goes on,[7] what is clear is that parts of the economy are exposed to PE’s worst management practices.

When many PE-owned companies promote the same principles of high leverage and short-term cash extraction through quick flips and dividend recapitalizations in a given industry, the entire sector can become a graveyard, as fashion retail experienced on both sides of the Atlantic.

Further, public services from hospitals, prisons and fire departments to airports and road tolls are now frequently targeted by PE firms. Supporters argue that PE capital can modernize outdated infrastructure and introduce greater efficiency, though evidence of lasting benefits is mixed. With so much dry powder sitting idle, financial sponsors have turned vast swathes of the public sector into their private kingdom.

In the United Kingdom, many water utilities have either experienced leveraged buyouts (LBOs) or adopted the PE trade’s playbook, with short-term profit maximization leading to chronic long-term underinvestment in infrastructure.[8]

In the United States, several sectors offering public services to a sticky or captured “customer base,” including healthcare[9] and higher education,[10] have experienced systemic failure. A research paper highlighted how a quasi-exclusive focus on profitability at US hospitals, many of them increasingly under PE-ownership,[11] affected care due to reduced medical staff, and led to a rise in hospital bills.[12]

Since no sector is deemed out of reach, it is fair to ask what could be the long-term impact of the widespread use of PE practices on key industries or even the broader economy.

Economic Contamination: How Leverage Extends Beyond the Balance Sheet

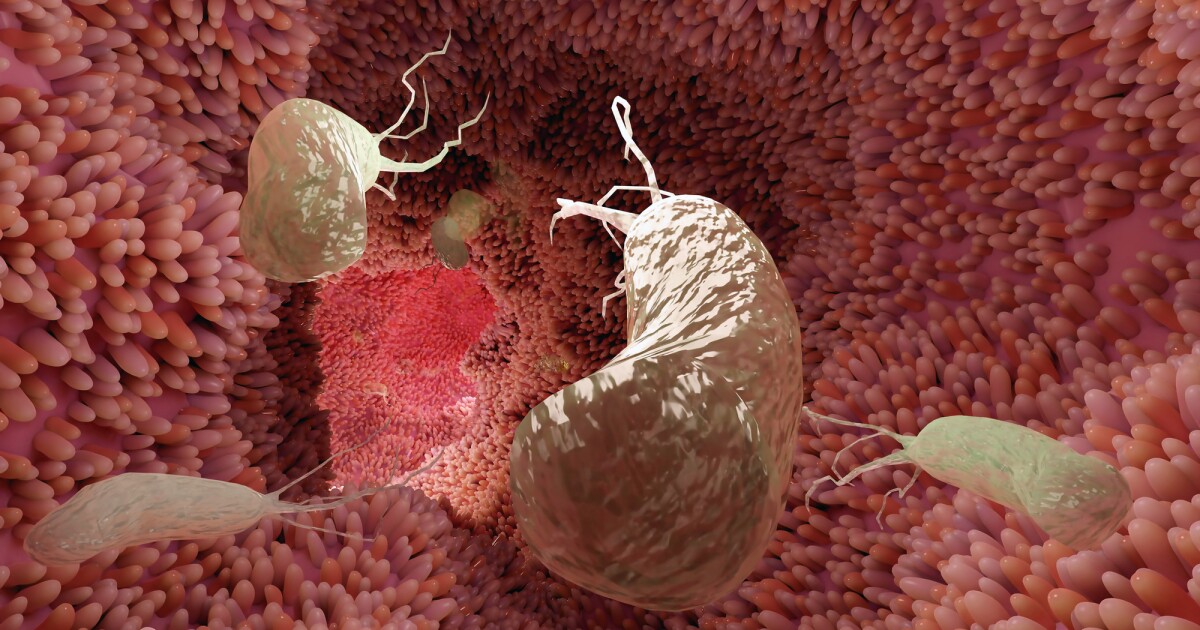

Too much debt can act as a poison that strikes at the genetic material of the economy and the business ecosystem. Those who argue that overleverage in private markets is not of a systemic nature adopt the meaning given by financial regulators when describing the banking sector in the aftermath of the GFC.[13] PE managers counter that leverage disciplines management teams and enhances returns, though the broader spillovers into labor markets and suppliers are harder to quantify.

Private capital practitioners contend that individual PE firms operate in closed and separate compartments. Contamination cannot therefore spread across the economy, especially because fund managers do not hold depositors’ money. While technically true, the reality is more complex.

In the last half century, debt was progressively substituted for equity in corporate capital structures.[14] Modern economies are therefore confronted with a serious problem: Permanent leverage.

The excessive use of debt can have disastrous consequences not just on the borrower but for its suppliers, contractors, employees and other business associates. Indeed, private capital-backed businesses do not operate in a silo. They impact other market participants. When overleverage becomes the default corporate management practice, as it is for companies under LBO, market risks pile up.

This is particularly true when borrowers are weakened concurrently by a rise in interest rates. As credit became dearer in the past three years, it acted as a toxic substance. The economic effects of debt overuse are likely to be cumulative over long periods of time, spurring the zombification of the corporate landscape,[15] job insecurity in private capital-fuelled sectors and underinvestment in product R&D and infrastructure.

In the hands of financial sponsors and private lenders, credit could become a no-holds-barred weapon of mass economic slumber. Even if a thorough process of deleveraging does not lead to a financial upheaval on par with the 2008 crisis, it could take many years for equity to gradually replace excess leverage through equity cures, leading to a protracted recession.

This, in turn, is likely to have a prejudicial impact on investment returns. Lower yields from private capital could induce a structural downfall in retirement pots: many institutional investors making capital commitments to alternative asset classes are pension fund managers.

Permanent Opacity: Why Visibility Matters for Investors

Private property is a core concept of capitalism, but in modern market economies it increasingly refers to the fact that many corporations remain permanently the property of PE firms.

Secondary buyouts (SBOs) frequently account for half of annual portfolio realizations, in part because few market participants other than financial sponsors are willing to bid for assets that have suffered years of overleverage. Pre-Covid vintages also hold overpriced businesses that benefited from all-time low interest rates.

A large number of PE-sponsored enterprises have undergone over three LBOs, with a not meaningless number of them on their fifth or sixth iteration. It is not inconceivable that some will remain in PE hands forever, or until market turmoil forces fund managers to relinquish control.

Yet, SBOs eventually proved an unreliable fix. Traditionally a fairly illiquid asset class to begin with, which explains the frequency of quick-turnover deals and dividend recaps, PE sought another solution to remedy the current weak deal environment.

Continuation vehicles (CVs) were meant to provide a fitting and temporary solution to fund managers facing the uncertain climate created by the economic response of the Covid pandemic. The sharp rise in inflation and interest rates in recent years had made deal making more arduous.

As always, both critics and proponents of this solution come up with valuable arguments. Critics state that CVs are a way for fund managers to avoid marking their portfolios to market, since external valuation advisers are paid by the fund managers and cannot therefore be deemed neutral, certainly not in the way stock market investors or external corporate buyers are.

Advocates of CVs argue that many of the portfolio companies transferred to continuation funds are generally quality assets with solid prospects for further growth and capital gains.

Unfortunately, since no independent third-party ever assesses what proportion of these portfolio companies are indeed premium assets, and because CVs have no track record, the risk is that a portion of these CV-backed assets are not adequately priced.

The important point is that CVs allow a fund manager to crystallize returns and pocket performance fees, regardless of whether the valuations used to transfer the assets are realistic or fabricated.

Worryingly, with still limited demand for their long-held assets, managers are now introducing continuation vehicles on continuation funds, also called CV-squared.[16] Private markets are turning into a crude commodity exchange where only insiders gain access.

CFA Institute Research and Policy Center will launch a three-part series on ethics in private markets this month, focusing first on continuation funds.

A New Definition of Systemic Risk: What Private Capital Could Mean for Markets

With the generalization of continuation vehicles, PE lives in a world of fiction and appearances. Valuations are generated in-house, often with the complicity of external advisers who bring to the exercise a pretence of independence and authenticity. This exercise adds another layer of opacity to the trade. The longer PE firms retain ownership of their assets, the less frequent the price discovery process. Market risks ought to rise accordingly.

With assets under management of less than $1 trillion a quarter of a century ago, about $19 trillion this year,[17] and a projected $60 trillion by 2032,[18] private capital represents an even larger share of financial markets, making these markets less liquid and more impenetrable as a result.

If PE practices are capable of destabilizing entire industries or hollowing out entire countries, can it not be argued that they could eventually magnify systemic risk?

Although it might not be capable of provoking a complete meltdown of the global financial system, due to structural opacity and overleveraging as well as the chronic self-dealing and sweating of assets, private capital could plunge developed countries into protracted economic turmoil.

For investors, the stakes are significant: opacity and permanent leverage may depress long-term returns, reduce liquidity, and complicate portfolio risk management.

[1] https://funds-europe.com/fca-is-keeping-close-eye-on-systemic-risk-following-private-equity-fears/

[2] https://ourfinancialsecurity.org/news/blog-opaque-private-credit-industry-threatens-heavy-debt-burdens-systemic-risk/

[3] https://www.mckinsey.com/industries/private-capital/our-insights/global-private-markets-report

[4] https://blogs.cfainstitute.org/investor/2022/02/09/private-equity-market-saturation-spawns-runaway-dealmaking/

[5] https://www.reuters.com/article/us-germany-privateequity/german-workers-take-on-private-equity-locust-idUSL2244583520070829/

[6] https://www.spectator.co.uk/article/how-private-equity-ruined-britain/

[7] https://www.ft.com/content/bb2a1ea3-d629-407e-b405-d5f009fc08e6

[8] https://www.theguardian.com/business/2023/jun/30/in-charts-how-privatisation-drained-thames-waters-coffers

[9] https://www.nakedcapitalism.com/2020/07/private-equity-and-the-pandemic-brace-for-impactinvesting.html

[10] https://www.businessinsider.com/wall-street-private-equity-billions-college-students-for-profit-college-2024-9

[11] https://pestakeholder.org/private-equity-hospital-tracker/

[12] https://business.depaul.edu/academics/economics/news-and-events/Documents/The%20Corporatization%20of%20Independent%20Hospitals.pdf

[13] https://en.wikipedia.org/wiki/Systemic_risk

[14] https://blogs.cfainstitute.org/investor/2021/03/24/capitalism-is-dead-long-live-debtism/

[15] https://blogs.cfainstitute.org/investor/2020/05/13/modern-private-equity-and-the-end-of-creative-destruction/

[16] https://pitchbook.com/news/articles/cv-squared-what-are-the-risks-of-pes-latest-liquidity-solution

[17] https://pitchbook.com/news/reports/2029-private-market-horizons

[18] https://www.bain.com/about/media-center/press-releases/2024/private-market-assets-to-grow-at-more-than-twice-the-rate-of-public-assets-reaching-up-to-$65-trillion-by-2032-bain–company-finds/