But before we dive into these further, an important note. The following options are meant to illustrate sample portfolios and do not constitute financial advice. If you haven’t already done so, review the principles behind how to build a couch-potato portfolio and our overview of couch potato investing before committing your hard-earned money to any of the investments indicated.

Option 1: Build a mutual fund portfolio

Most Canadian banks offer a selection of relatively low-cost index mutual funds with which you can build your own balanced portfolio. Depending on your relationship with the institution, they may throw in advice for free.

Your mutual fund options

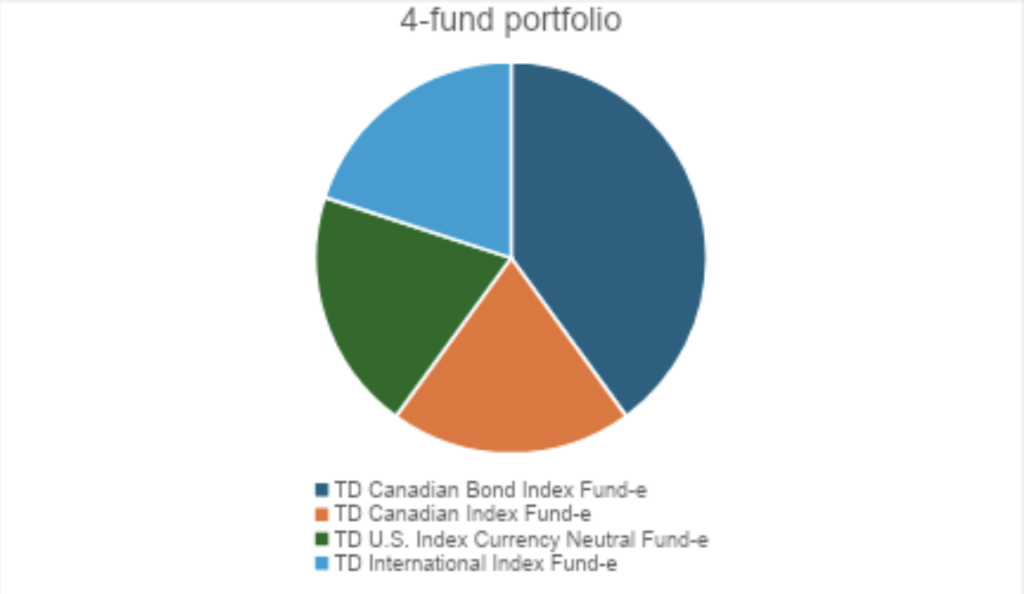

TD is the best-known provider in this space with its e-Series funds, but Scotiabank, RBC, and CIBC, among others, have similar products.

The pie chart below illustrates how a typical mid-career investor with a moderate risk tolerance might construct a portfolio using e-Series funds. More conservative investors would typically increase the fixed-income allocation as high as 80%, while more growth-oriented investors might reduce the fixed income component to 20% or less.

Tangerine Bank, the online banking subsidiary of Scotiabank, lets you simplify the process further with a single, all-in-one product—similar to the asset-allocation ETFs described below but marketed as a mutual fund. You can find your choice of Tangerine Core Balanced Portfolio (60% stocks, 40% bonds), Core Balanced Income Portfolio (70% bonds, 30% stocks), Core Balanced Growth Portfolio (75% stocks, 25% bonds), Core Equity Growth Portfolio (100% global stocks), and Core Dividend Portfolio (100% dividend stocks), depending on your risk/return profile and investing style.

Mutual fund fees

While cheaper than actively managed mutual funds, index mutual funds still tend to charge management expense ratios (MERs)—annual fees represented as a portion of your total account, deducted from your returns—that are higher than equivalent exchange-traded funds (ETFs). TD’s e-Series has MERs of 0.25% to 0.5%. Tangerine’s complete portfolios run just over 1%.

Mutual fund pros and cons

Compare the best TFSA rates in Canada

Option 2: Build an ETF portfolio

A core index ETF portfolio can consist of as little as two and up to four ETFs. Core exposures required include the U.S., Canadian, and International equities markets and domestic fixed income.

The sample portfolios here are balanced for moderate risk and return potential. More conservative and growth-oriented investors can adjust their portfolios to skew more towards fixed income or equities. See the section on asset-allocation ETFs below for examples.

Your ETF options

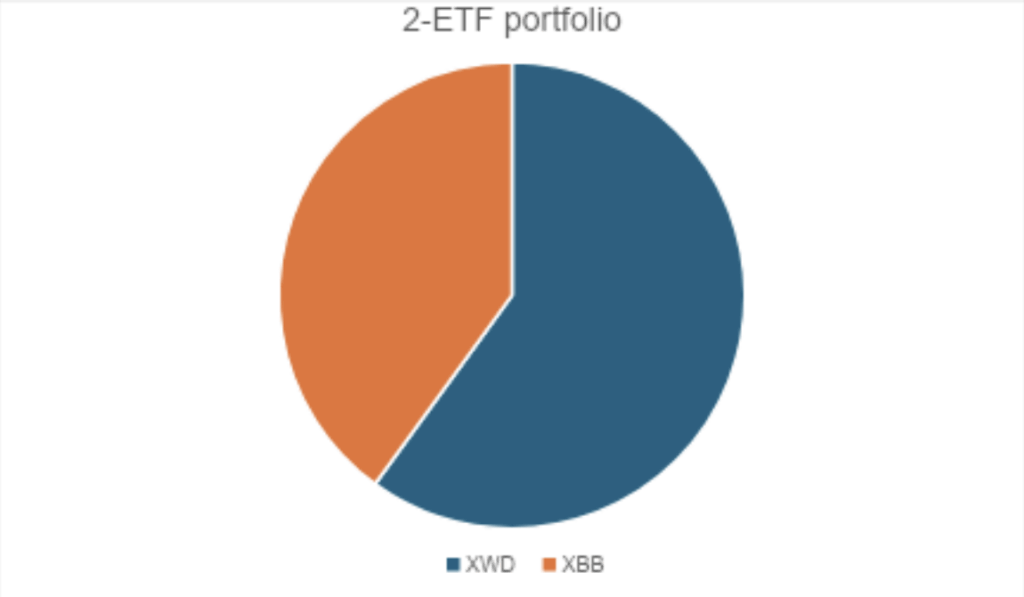

The simplest approach is to buy a broad bond market fund such as iShares Core Canadian Universe Bond ETF (XBB) or Vanguard Canadian Aggregate Bond ETF (VAB) and a global equity ETF that takes in all geographies such as iShares MSCI World Index ETF (XWD). This will reduce your Canadian equity exposure to just 2% and raise your U.S. stock allocation to almost 40%—a good thing in some investors’ minds, bad in others’. Another potential downside is cost: global funds tend to have MERs of 0.2%, more than U.S. and Canadian equity funds.

We have used iShares funds in the example below, but there are comparable offerings from BMO, Vanguard, TD, and Global X. For specific fund recommendations, check out MoneySense’s annually updated guide to the best ETFs.

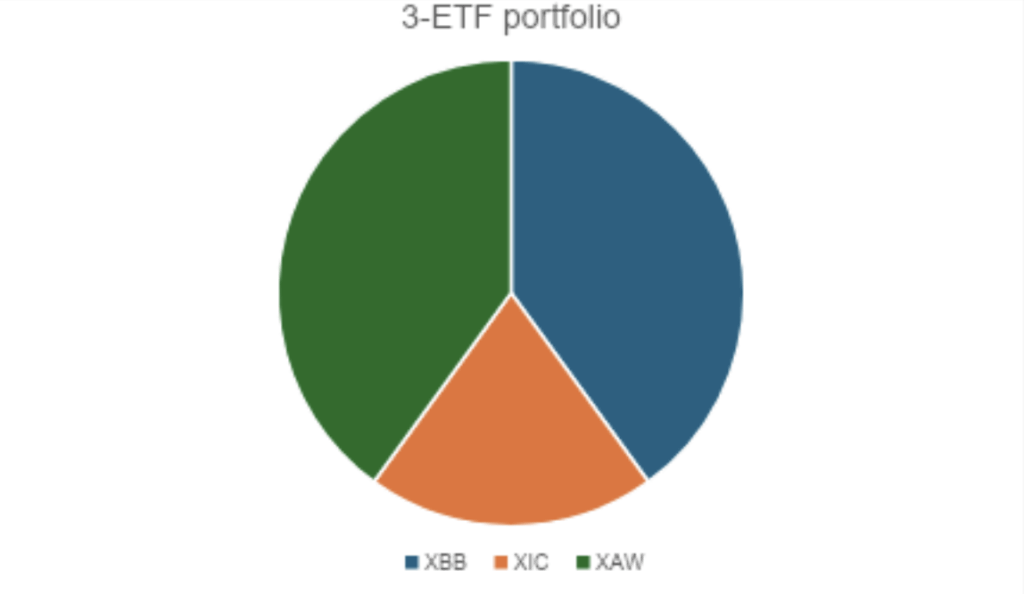

Option 2b (below) features three funds: fixed income, global equities excluding Canada, and Canadian equity. This lets you set your own preferred level of Canadian content, as well as enjoy low Canadian equity ETF fees and tax efficiency if the account is taxable.

For the Canadian equity portion, we have chosen iShares Core S&P/TSX Capped Composite Index ETF (XIC). You can find more good Canadian equity ETF options in our ETFs guide. For Global equity, we used iShares Core MSCI All Cap World ex-Canada Index ETF (XAW). Again, you can find equivalents from rival fund companies such as Vanguard and BMO.

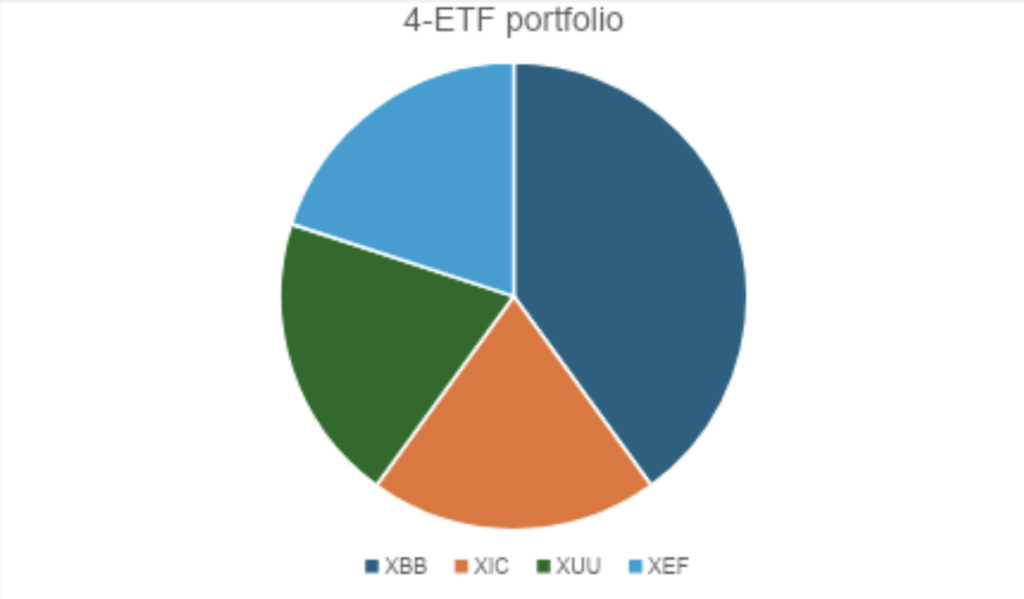

Option 2c takes in separate funds representing fixed income, U.S. equities, Canadian equities, and international equities (developed markets outside North America). The greater complexity brings with it potential cost savings, but also a greater need to monitor the portfolio and rebalance.

Along with XBB and XIC, we have sampled iShares Core S&P US Total Market Index ETF (XUU) and iShares Core MSCI EAFE IMI Index ETF (XEF). Find more suitable funds for these core positions in our most recent best U.S. Equity ETFs and best International Equity ETFs surveys.

ETF fees

Barring frequent trading that incurs brokerage fees, the index ETF portfolio is the lowest-cost approach available to couch-potato investors. Combined, your fixed income and equity allocations will have average MERs around 0.1% per year (slightly higher for international equity). You’ll barely notice it.

ETF pros and cons

Option 3: Buy an asset-allocation ETF

“Asset allocation ETF” is the term most often used in the investment industry, but they are variously known as one-ticket, all-in-one, one-decision and multi-asset ETFs. Essentially, they invest usually in the fund company’s own index ETFs to offer a whole portfolio’s worth of exposure in one investment. Just buy one, set your brokerage account preference to DRIP (dividend reinvestment program) so that quarterly distributions get invested in more units, and you really can “set it and forget it.”

Your asset-allocation ETF options

There isn’t a lot to separate the major ETF providers in the asset-allocation space. The bigger decision you have to make is where you want to fall on the risk/return spectrum. The most conservative option, for money you might need in the next year or two, is not to use a multi-asset fund at all, but instead one invested in high interest savings accounts (HISAs) or the money market. (See MoneySense’s best cash alternative ETFs for suggestions.)