South Korea is taking a major step toward stablecoin oversight and digital currency development. According to a July 29 report from Yonhap News, the Bank of Korea has announced the installation of a new virtual asset division within its Financial Settlement Bureau. The newly formed division will monitor the broader crypto market and lead internal discussions specifically focused on the development and regulation of Korean won-based stablecoins.

As part of a broader organizational shift, the central bank will rename its Digital Currency Research Lab to the Digital Currency Lab starting July 31. This change is intended to reflect a transition from pure research toward more business-oriented development. Additionally, Team 1 and Team 2 of the former Digital Currency Technology Division will be restructured into two new units: the Digital Currency Technology Team and the Digital Currency Infrastructure Team. These teams will focus on privacy-preserving technologies, deposit-token platforms, and testing environments for stablecoin usability.

This reorganization signals South Korea’s growing commitment to leading in digital currency innovation. As stablecoins and central bank digital currencies (CBDCs) gain global momentum, the Bank of Korea appears to be aligning its internal infrastructure for a more hands-on, policy-driven role in the future of money.

Bank of Korea Signals Stronger Commitment to Stablecoin Development Despite Test Delays

A Bank of Korea official recently clarified the purpose behind renaming its Digital Currency Research Lab to the Digital Currency Lab, stating, “We wanted to make it clear that this is not a department that only does research, as there is no other department that uses the word ‘research’ in its name other than the Economic Research Institute.” The change underscores the central bank’s intention to align the unit with broader operational and policy-driven responsibilities. However, the official also noted, “There will not be much change in the original work.”

The Digital Currency Lab, which evolved from the Research Department earlier this year, remains at the forefront of South Korea’s central bank digital currency (CBDC) initiatives. One of its key projects is “Project Han River,” a long-term initiative designed to test the real-world usability of a digital won. The first phase of testing concluded successfully at the end of last month, but the second phase has been put on hold. The delay stems from concerns raised by participating banks over the lack of a long-term roadmap and the financial burden of continued participation.

Despite the temporary suspension, Bank of Korea Governor Lee Chang-yong emphasized during a press conference on July 10 that Project Han River aims to “safely introduce a won-denominated stablecoin.” He added, “Whether it’s a won stablecoin or a deposit token, digital currency is needed in the future.”

This reinforces a key trend in global finance: the accelerating adoption of stablecoins beyond the US. South Korea’s evolving framework highlights the increasing importance of national stablecoin initiatives, particularly as countries seek to modernize payment systems and maintain sovereignty over digital financial infrastructure.

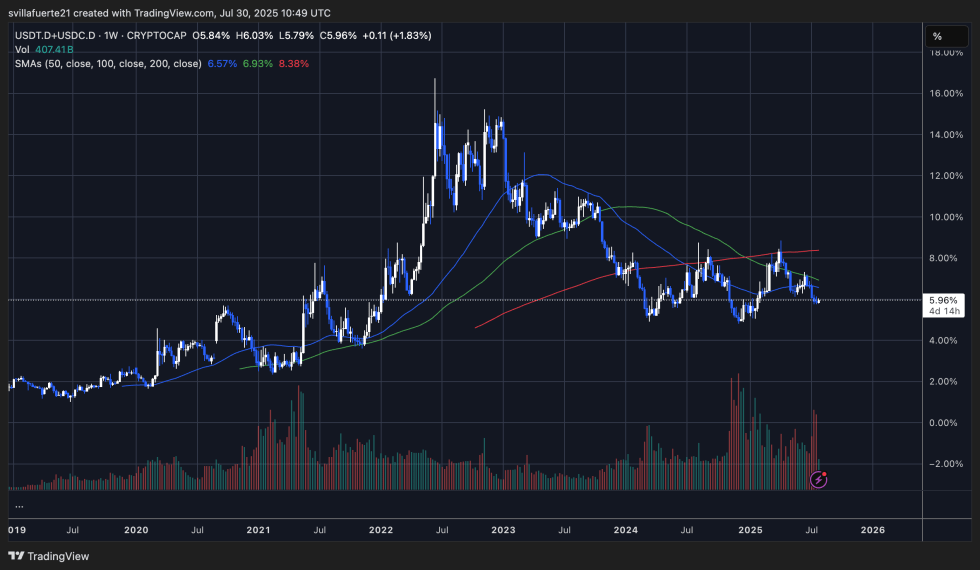

USDT and USDC Dominance Holds Near 6%

The combined dominance of USDT and USDC currently sits at 5.96%, according to the weekly chart, reflecting a relatively neutral stance in stablecoin capital positioning. After peaking above 18% in early 2022—during a period of heavy risk-off sentiment—the metric has been on a gradual decline, indicating a shift of capital out of stablecoins and back into risk assets.

The chart shows that USDT+USDC dominance has consistently struggled to hold above the 50-week (6.57%), 100-week (6.93%), and 200-week (8.38%) moving averages. Recent price action confirms resistance near these levels, with dominance now testing its mid-cycle support around the 6% threshold.

This downtrend typically suggests growing risk appetite, as capital rotates out of stablecoins and into volatile assets like BTC, ETH, and altcoins. However, the fact that dominance has not broken below 5% reflects a cautious market that still maintains a strong base of sidelined capital.

Featured image from Dall-E, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.