The price of Bitcoin has had quite the rollercoaster ride over the last seven days, rising from its early-week blues marked by a crash to below the $100,000 mark. The flagship cryptocurrency has roared back to life, running to as high as $108,000 in the past few days.

This recent resurgence has not particularly reflected on the blockchain, with the latest on-chain data suggesting that traders are not willing to bet on Bitcoin’s price. A popular market analytics platform has now evaluated this scenario, putting forward the potential impact on price.

Declining Funding Rates Reflect Increased Short-Side Positioning: Glassnode

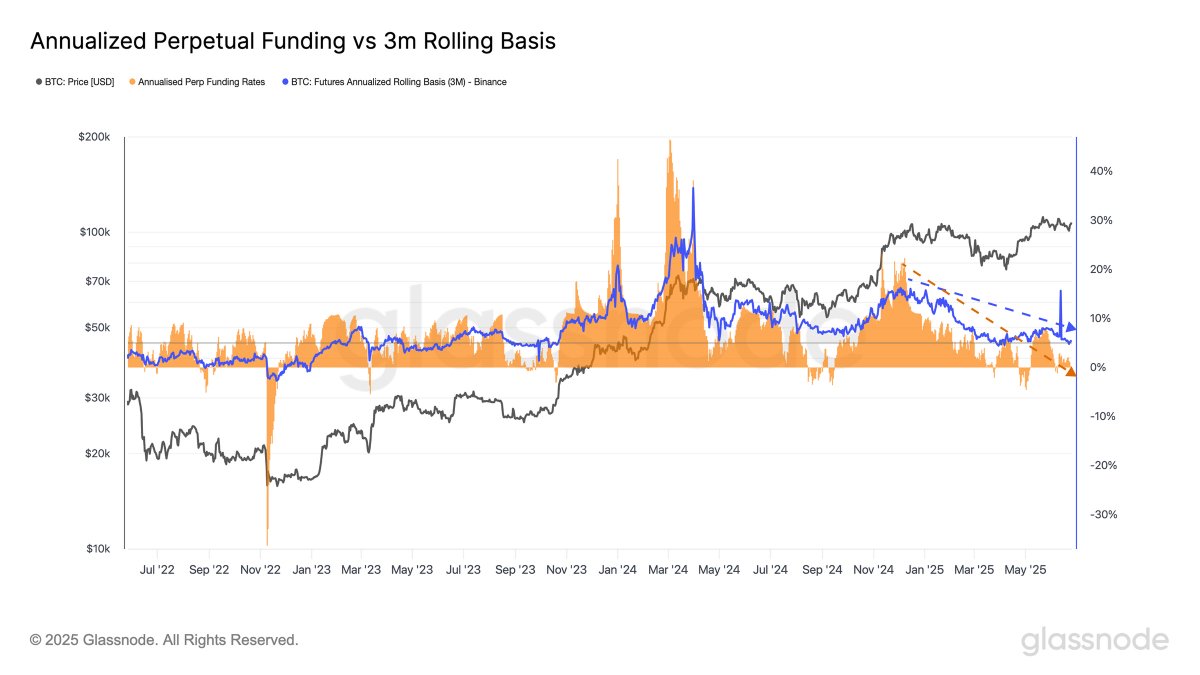

In a June 27 post on the X platform, on-chain analytics firm Glassnode revealed that the funding rate for Bitcoin, which has been on a decline over the past few months, seems to be stuck in a downward trend. The relevant indicators here are “Annualized Perpetual (perp) Funding Rates” and “Binance 3-Month (3M) Futures Annualized Rolling Basis” metrics.

The Annualized Perp Funding Rates is a key metric that tracks the periodic payments between long and short traders in the derivatives (perpetual futures) market. This indicator offers timely insights into the sentiment and leverage in the cryptocurrency derivatives market.

When the funding rate is high or positive, it implies that the long traders are paying the traders with short positions. Typically, this direction of the periodic payment suggests a strong bullish sentiment in the market. Meanwhile, a negative value of the metric means that short traders are paying long traders — suggesting a bearish market sentiment.

On the other hand, the 3-Month (3M) Futures Annualized Rolling Basis estimates the annualized yield from buying a cryptocurrency on the spot market and concurrently selling the crypto’s futures contract expiring in 3 months. Typically, futures contracts trade at a higher price than the spot asset — a difference that traders can exploit for profit.

Source: @glassnode on X

As shown in the chart above, the Annualized Perp Funding Rates and 3-Month (3M) Futures Annualized Rolling Basis have been falling since last November. “Despite high futures activity, appetite for long exposure is fading, reflecting increased caution and possibly more neutral or short-side positioning,” Glassnode noted.

In essence, the declining funding rates and 3-month rolling basis indicate that short traders are continuously crowding the derivatives market. While there has been a cautious approach to the market from traders, institutional flows into US-based Bitcoin exchange-traded funds and an improving macroeconomic climate have been quite a silver lining.

Hence, even if the funding rates keep falling, but the macroeconomic environment and institutional capital inflow remain steady, the market could witness a short squeeze — where short traders are forced to close their positions. This potential scenario is even supported by the fact that the market tends to move in the crowd’s opposite direction.

Bitcoin Price At A Glance

As of this writing, the price of BTC stands at around $107,180, showing no significant movement in the past 24 hours.

The price of BTC on the daily timeframe | Source: BTCUSDT chart on TradingView

Featured image from iStock, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.