Bitcoin is up 9% since last Sunday, showing renewed strength as it approaches key resistance levels. After weeks of choppy price action and uncertainty, momentum is building across the crypto market. Traders and analysts alike are closely watching Bitcoin’s next move, with many calling for a potential breakout above the all-time high. With bullish sentiment rising and liquidity returning to risk assets, a decisive move could be imminent.

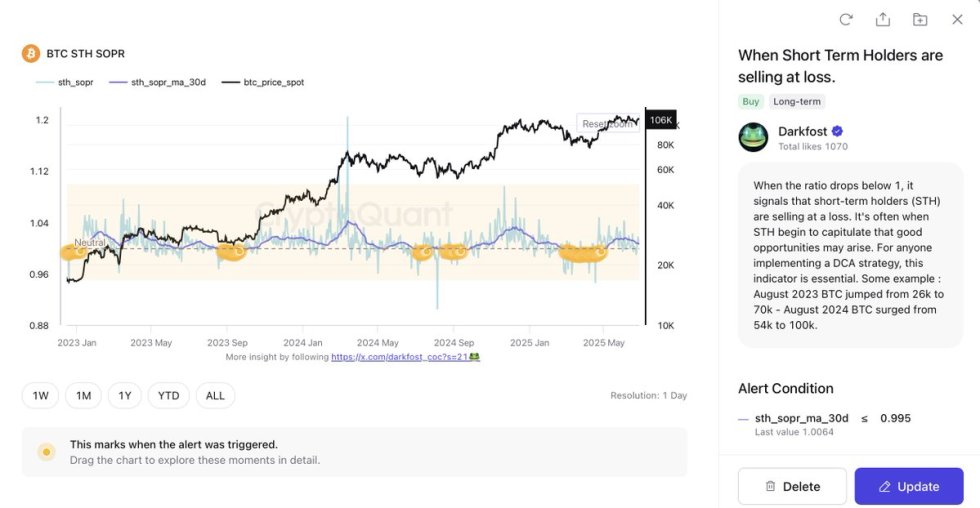

Supporting this outlook is a key on-chain signal highlighted by top analyst Darkfost. According to his insights, the short-term holder (STH) realized price ratio recently dropped below 0.995—a level that historically signals STHs are capitulating and selling at a loss. This behavior typically emerges during local bottoms, often presenting high-reward opportunities for long-term investors. It’s these moments of weakness that frequently precede strong recoveries and upward trends.

As Bitcoin pushes higher, the broader market remains optimistic that a confirmed breakout could shift momentum across the altcoin sector as well. For now, the focus remains on whether BTC can sustain current gains and break through resistance decisively. With strong fundamentals, growing institutional interest, and supportive on-chain data, Bitcoin’s next major move may be just around the corner.

Bitcoin Faces Critical Test As Market Awaits Next Move

Bitcoin is once again at a crucial juncture, hovering between its all-time high of $112,000 and key support at $105,000. Bulls are working to break above resistance and spark the next leg higher, while bears aim to drag the price below support and shift momentum in their favor. This standoff has created a volatile and indecisive environment, with price swinging between these levels for days. So far, neither side has been able to establish dominance, leaving traders on edge as the next major move begins to take shape.

Adding to the broader market optimism is the US stock market, which has just reached a new all-time high. Many analysts see this as a leading indicator for crypto, suggesting that Bitcoin and altcoins could be next in line to follow the rally. Liquidity conditions are improving, and risk appetite is returning, setting the stage for a potential breakout if Bitcoin can overcome resistance.

Darkfost recently shared a key on-chain signal supporting this outlook. According to his analysis, the Short-Term Holder Spent Output Profit Ratio (STH SOPR) has dropped below 0.995. Historically, this level indicates that short-term holders are capitulating and selling at a loss—a behavior often seen at local bottoms. When STHs exit in fear, it tends to clear the way for stronger hands to accumulate, laying the groundwork for the next leg up.

With bullish macro signals and on-chain metrics aligning, Bitcoin’s current range could soon give way to a major move. Whether that breakout happens above $112K—or a breakdown below $105K—will determine the tone of the next chapter in this market cycle. For now, all eyes remain on Bitcoin.

BTC Price Action: Testing Key Resistance

Bitcoin is currently trading at $107,321, consolidating just below the critical $109,300 resistance level. This zone has acted as a ceiling for over a month, with multiple failed attempts to break above. The latest recovery from the $103,600 support has been strong, with BTC reclaiming all key moving averages—50 SMA ($105,774), 100 SMA ($105,866), and staying well above the 200 SMA ($97,046)—showing a shift in short-term momentum toward the bulls.

The 12-hour chart displays a clear pattern of higher lows, indicating that buyers are stepping in with increasing confidence. However, the lack of volume during this latest push suggests hesitation, as traders await a confirmed breakout before fully committing. For Bitcoin to gain significant upside traction, it must close multiple candles above $109,300, turning resistance into support.

If bulls fail to break above resistance soon, the $105,000–$103,600 zone becomes the critical area to hold. A breakdown below this range could open the door for a deeper retracement toward the 200 SMA around $97,000. Until then, BTC remains in a neutral-to-bullish posture, with the market watching closely for a decisive move that could shape the next leg of this cycle.

Featured image from Dall-E, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

![These AI workflows can 10X your marketing productivity [+ video] These AI workflows can 10X your marketing productivity [+ video]](https://www.hubspot.com/hubfs/Untitled%20design%20-%202025-05-29T135332.005.png)