When managing your finances, selecting the right budget analysis tool is essential. Each tool offers distinct features customized to various budgeting needs. For instance, EveryDollar focuses on zero-based budgeting, whereas Wallet by BudgetBakers excels in cash flow monitoring. Furthermore, Lunch Money is perfect for desktop users, and Rocket Money simplifies subscription management. Monarch offers a strong alternative to Mint with flexible budgeting options. Comprehending these tools can help you make informed decisions about your financial management strategy.

Key Takeaways

- EveryDollar is ideal for zero-based budgeting, ensuring every dollar is allocated to expenses, savings, or debt repayment.

- Wallet by BudgetBakers excels in cash flow monitoring with automatic syncing from over 15,000 financial institutions.

- Lunch Money is a strong desktop budgeting tool, offering automatic transaction imports and flexible payment options.

- Rocket Money simplifies subscription management, allowing users to track and cancel unwanted recurring payments effortlessly.

- Monarch serves as a robust alternative to Mint, featuring flexible budgeting and expense tracking for personal finance management.

EveryDollar: Best for Zero-Based Budgeting

EveryDollar stands out as an outstanding option for those interested in zero-based budgeting, a method that guarantees you allocate every dollar of your income toward specific expenses, savings, or debt repayment.

As one of the best budgeting apps available, it offers a straightforward setup and a clean interface, making it ideal for users seeking effective personal finance software.

Although there are free budgeting apps out there, EveryDollar’s features—like unlimited coaching and customizable budgets—enhance your financial management experience.

It likewise excels as a budget planner and budget tracking app, though you’ll need a paid account for automatic syncing.

Keep in mind that it lacks built-in bill payment features, which could influence your choice among savings management software vendors.

Wallet by BudgetBakers: Best for Cash Flow Monitoring

For individuals focused on effectively managing their finances, Wallet by BudgetBakers offers an excellent solution for cash flow monitoring. With a stellar 5.0-star rating, it stands out as one of the best budgeting apps available. This personal finance tracker features automatic syncing with over 15,000 financial institutions, allowing you to track expenses and income in real-time. Users have rated it 4.5/5 on Android and 4.6/5 on iOS, showcasing high user satisfaction. Wallet provides a budget application free version, alongside premium plans starting at $5.99/month, making it accessible for various budgets.

| Feature | Description | User Rating |

|---|---|---|

| Syncing | Connects with 15,000+ institutions | 4.5/5 (Android) |

| User Experience | Intuitive design | 4.6/5 (iOS) |

| Cost | Free version and premium plans | 5.0/5 |

Lunch Money: Best for Desktop Budgeting

Lunch Money emerges as a strong tool for individuals seeking effective desktop budgeting solutions. With a high rating of 4.6/5 on Android and 4.9/5 on iOS, it stands out as one of the best budgeting software options available.

Here’s what you can expect:

- Automatic transaction imports streamline your financial tracking.

- Recurring expense tracking helps you manage your monthly budget planner effortlessly.

- Multi-currency support accommodates diverse financial situations.

Offering flexible payment options ranging from $50 to $150 annually or $10 monthly after a free trial, Lunch Money‘s desktop budgeting capabilities and streamlined interface make it a top contender among personal budgeting apps and the best financial planning apps for thorough financial management.

Rocket Money: Best for Managing Subscriptions

Managing subscriptions can often become a hassle, especially as various services accumulate over time. Rocket Money stands out as one of the best budgeting tools for simplifying this process.

With its user-friendly design, it helps you track and manage recurring payments effortlessly. This app not just serves as a personal finance budget calculator but likewise offers unique features, like canceling unwanted subscriptions on your behalf, which can greatly reduce unnecessary expenses.

Rated highly by users—4.7/5 on Android and 4.5/5 on iOS—Rocket Money provides helpful notifications and insights.

As one of the best free budgeting apps, it’s perfect for managing online finances, serving as an effective monthly budget planner and credit card spending tracker for individuals and couples alike.

Monarch: Best for Replacing Mint

If you’re searching for a robust alternative to Monarch, Monarch might be the perfect solution for you. Rated 4.7/5 on Android and 4.9/5 on iOS, this app thrives in personal finance management.

Monarch offers flexible budgeting features, making it one of the best budget apps available.

- Create custom categories customized to your financial goals

- Track monthly expenses with ease

- Utilize tax-related transaction tracking for year-round financial management

With a subscription of $99.99 per year or $14.99 per month after a seven-day free trial, Monarch serves as an all-in-one personal budget calculator and manage expenses software.

It stands out as the best budgeting software for couples, ensuring you have the tools to track your spending effectively.

Frequently Asked Questions

What Are the Best Budget Tools?

When considering the best budget tools, you should evaluate options based on your specific needs.

EveryDollar offers a zero-based budgeting approach, whereas Wallet provides excellent cash flow monitoring with automatic syncing.

If you prefer desktop budgeting, Lunch Money supports multiple currencies.

Rocket Money helps manage subscriptions effectively, and Monarch offers thorough financial management features.

Assess the pricing and functionalities of each tool to find the best fit for your financial goals.

What Software Does a Budget Analyst Use?

As a budget analyst, you typically use various software tools to improve your financial planning. You might rely on dedicated budgeting software like PlanGuru for in-depth analysis and forecasting.

QuickBooks Online and Xero are likewise popular because of their real-time expense tracking.

Excel and Google Sheets offer flexibility, though they require careful management to avoid errors.

For advanced needs, you might consider tools like Prophix or Float, which provide automation and cash flow insights.

What Is a Financial Analysis of the Budget?

A financial analysis of the budget involves evaluating your organization’s income and expenses to gauge adherence to financial plans.

You identify variances between budgeted and actual figures, helping you make necessary adjustments. Key metrics like revenue growth and cash flow projections are assessed to align with business objectives.

This analysis uncovers spending and revenue trends, aiding in forecasting future performance and promoting accountability among stakeholders, ensuring informed decision-making based on accurate data.

What Are the Three Main Types of Budgets in Financial Management?

The three main types of budgets in financial management are operational, capital, and cash flow budgets.

Operational budgets focus on daily expenses and revenues, typically covering one year.

Capital budgets prioritize long-term investments in assets, often extending over several years.

Cash flow budgets project cash inflows and outflows, helping guarantee liquidity.

Each type serves a distinct purpose, enabling you to allocate resources effectively, plan for growth, and maintain financial stability.

Conclusion

In conclusion, selecting the right budget analysis tool can greatly improve your financial management. EveryDollar is ideal for zero-based budgeting, whereas Wallet by BudgetBakers stands out in cash flow monitoring. If you prefer desktop use, Lunch Money is a strong candidate. For effortless subscription management, Rocket Money shines, and Monarch serves as a thorough alternative to Mint. By evaluating your specific needs, you can choose the tool that best supports your financial goals and boosts your budgeting experience.

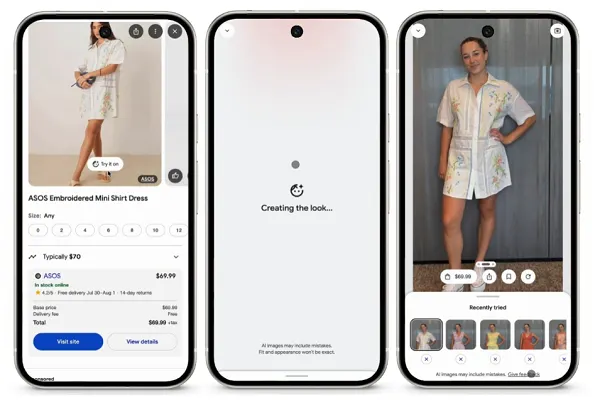

Image Via Envato